By ABI Research November 25, 2024

Collected at: https://www.rcrwireless.com/20241125/uncategorized/ai-5g-abi-research

How can mobile operators proactively manage the transition to using AI in 5G networks?

5G networks are mainstream and deployed nationwide across most developed markets in both East and West. Utilization of these networks is increasing as more affordable 5G handsets enter the market and mobile operators start to shift subscribers to 5G networks.

The new generation has introduced a significant increase in capacity and capability of carrying more traffic, especially with the introduction of Massive MIMO, which in some cases has improved capacity by 10 times compared to 4G. 5G-Advanced will evolve this even further, with bandwidth, latency and reliability improvements as well as the introduction of few device classes (e.g. RedCap) for new use cases. But even the prowess of 5G cannot guarantee that network capacity will be adequate for many years, especially as new use cases, devices and AI applications proliferate.

In this article, we will try to understand and uncover the implications of AI in the 5G network and how mobile operators can proactively manage this transition.

5G traffic patterns

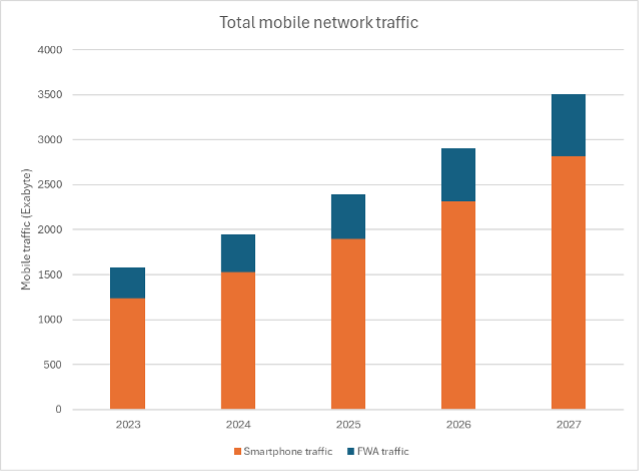

5G traffic has continued to increase, albeit at a reasonable pace in the last year. The combination of better handsets coupled with faster communication speeds has created the foundation for better consumer experiences and more complex enterprise applications. As such, average device traffic on 5G networks is typically 5-10x higher than 4G networks and this will continue to increase as more 5G devices enter commercial use. Some network operators report a decline in annual traffic growth, mostly stemming from the use of more advanced and efficient video codecs. But regardless of these improvements, external factors will likely congest 5G networks in the next 2-3 years, especially if they are used to deliver Fixed Wireless Access (FWA) services to many subscribers. For example, T-Mobile US claims that an average FWA subscriber uses 500GB/month, which is a start difference to a typical smartphone user who consumes 10 times less.

The following chart illustrates mobile and FWA subscription traffic in the next few years.

These forecasts assume that traffic patterns and consumer behavior will be evolving in a linear manner, leading to predictable traffic behavior, even though we cannot fully account for new applications and content types. On the other hand, early indications are now showing that these traffic patterns may be completely disrupted using AI within and outside the network.

Rise of AI in telecoms

The implementation of AI in 5G — and all telecom — networks, will likely come in phases and the market is now in the very first phase of this journey towards end-to-end automation. New consumer AI applications, new ways of automating the network using AI, and various GenAI use cases are surfacing. None of these are in the mainstream or have reached a critical mass of adoption, meaning that none of their functionality or components are integrated into the 5G network, which acts as an underlay for AI today. This will likely create significant strain from many perspectives:

- New use cases will create new traffic profiles, like the way smartphones disrupted, and congested 4G networks. These applications are already coming to smartphones, including GenAI models that upload photos and videos for post-processing. Live streaming and social media are already shifting more traffic towards the uplink as well, which will also become more important as some AI payloads move to the device.

- Network automation using AI algorithms will likely require significant amounts of data for training, often to be collected from end user devices and the network itself. This will likely create an increase of traffic in the short and mid-term, before these algorithms are able to optimize and automate traffic management.

- Last but not least, many third-party applications, including LLMs models, will likely need to collect data points from cellular devices, as well as transfer training parameters to the edge for inferencing. This will create additional traffic patterns that are not comparable to smartphone traffic patterns.

To put these into perspective, it’s easier to consider applications that are already in the market but not yet large scale.

New use cases, new devices

Smart glasses are a prominent category, with RayBan making the concept appealing to the average consumer. Although these devices are not yet mainstream, their entry into the market can create new traffic patterns. For example, the RayBan smart glasses record and transmit 1440×1920 video at 30 frames per second, which translates to between 2 and 15Mbps of capacity required in the uplink. For the time being, these smart glasses connect to a smartphone via Wi-Fi or Bluetooth, which will upload the video to the Web. The downlink/uplink ratio for these smart glasses is 1/200, consuming almost nothing on the downlink. Thousands, or even hundreds of these kind of devices across a network in a city will start to shift traffic patterns towards the uplink, causing operators to consider shifting more resources to the uplink.

In the enterprise domain, low altitude economy use cases are becoming more popular in China where low altitude drones are used for transport, deliveries and various other use cases. These drones will only likely upload telemetry, images and videos to the network, notifying their control center about their progress and environment. Contrary to the smart glasses example above, these new devices will likely create a much higher amount of traffic, especially in an emergency when they must transmit large amounts of data.

Both applications represent new business opportunities for mobile operators, especially when coupled with a new technology such as 5G-Advanced. For example, mobile operators can create new packages and plans for smart glasses or new devices as well as customize their network for enterprise use cases. For example, enterprises can opt-in for traffic prioritization for mission-critical use cases, including the drone example above. Network developments, including 5G Advanced, allow operators to turn new market trends into business opportunities.

AI will accelerate network evolution

ABI Research expects AI to put increasing strain on 5G networks, which will require additional investments, especially on the uplink. The next upgrade wave is 5G-Advanced which offers more bandwidth, capacity and efficiency improvements over 5G, as well as introducing a new device category (RedCap), making several use cases more efficient. There are many improvements introduced with 5G Advanced, including advanced Massive MIMO and flexible use of resources, accurate positioning, enhanced mobility, resilient timing and many more improvements.

The two examples above can only provide a glimpse of the next wave of cellular AI applications, which may likely congest 5G networks. Another catalyst may be the transition from cloud AI training to the edge, where AI models will likely be trained much closer to the data collection points, thus reducing transport costs to and from data centers. However, this may have effect at the cellular network, where an AI training/inference algorithm deployed at the cell site or aggregation point may require more data from connected sensors or devices. Mobile network operators are executing their strategies to be key players in the AI market, meaning their networks may soon completely change in terms of characteristics and traffic profiles.

In conclusion, this article suggests that mobile network operators consider network upgrades to 5G-Advanced are parallel to the adoption of AI, and can provide a solid foundation for their AI strategy. Failing to do so proactively may lead to their stagnation, remaining bystanders as cloud providers and AI startups reap the benefits of this new world.

Leave a Reply