By James Blackman November 26, 2024

Collected at: https://www.rcrwireless.com/20241126/internet-of-things-4/end-nb-iot-att

Does AT&T’s decision to ditch NB-IoT in the US, confirmed in RCR Wireless last week, spell the end for this clever and brave little IoT network technology? Just as a technology, the answer is: no, probably not – at least until LTE, whose ‘guardband’ it occupies, is retired in the middle of next decade. But as a global one, the answer is: yes, surely – that this finally explodes the hair-brained notion that NB-IoT was ever a global solution in its own right. It was, and will surely remain, a rather parochial affair. That must be its legacy; that, after nine years of stop-start momentum, NB-IoT has been revealed for what it really is: a useful technology for mostly-static in-market IoT monitoring.

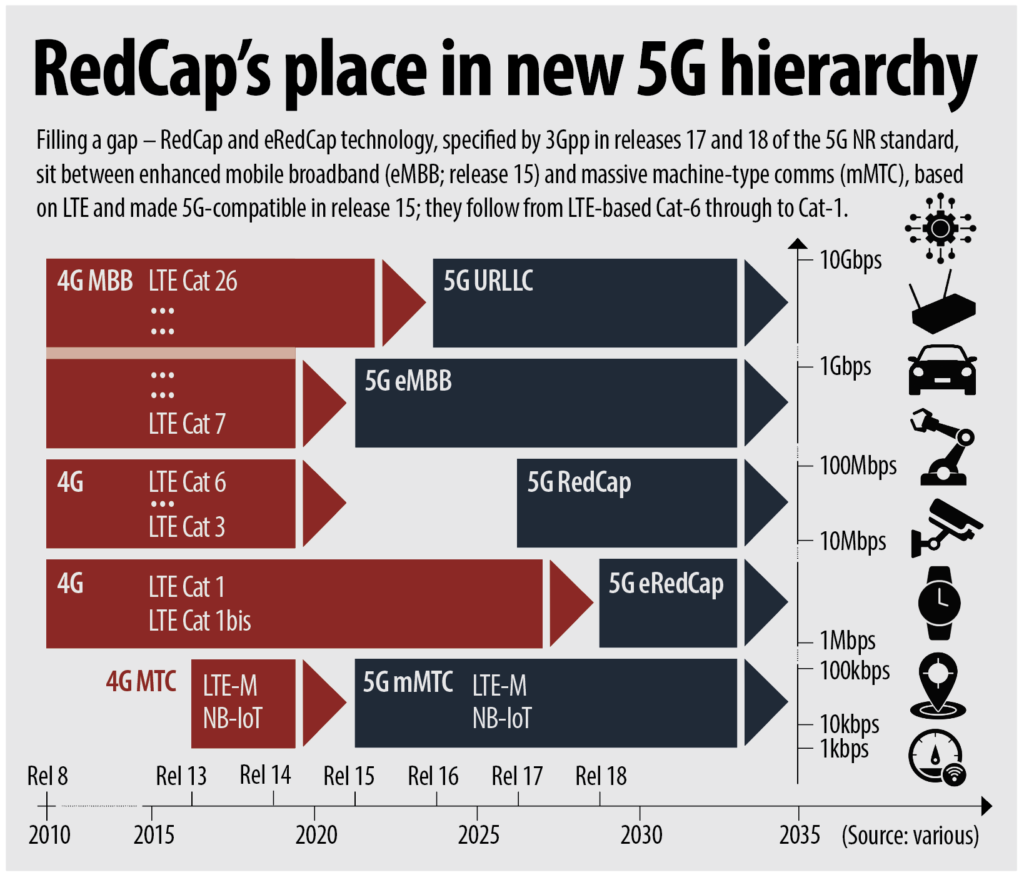

It was never really geared for inter-market IoT tracking – in part because of the limitations of its coverage footprint, especially in the US, but also because of its own mobility characteristics. LTE-M was always better for that. And yet the whole tragedy is that these twin technologies, NB-IoT and LTE-M, designed for low-power low-margin IoT, split the global market and cannibalised their reach – which forced vendors to choose them both, often, which drove IoT costs upwards and IoT margins down. In sum: what a mess. Which is why there is presently such a hullabaloo about reduced (and further-reduced capability) -capability 5G (5G RedCap and eRedCap).

It is why there are so many questions about the significance of AT&T’s move; and why RCR Wireless rounded-up some answers to them. Enter the ever-reliable Matt Hatton, founding partner at Transforma Insights. He says: “There’s a general friction in the use of IoT-specific public networks. Coverage is patchy and roaming is awful. So there’s a retrenching going on – to piggyback on tried-and-trusted consumer networks. The increasing use of LTE Cat-1bis is a good example. Which is bad news for NB-IoT, LTE-M (to a lesser extent), and public LoRaWAN. That said, there is a valid case for IoT-specific networks on a country-by-country basis.”

He explains: “If millions of meters use NB-IoT, then NB-IoT will persist in that country. But [it becomes a tech] for domestic use cases [and not global ones]. Same for any technology; they [just] become more focused on domestic use cases. For this reason, we probably shouldn’t assume there will be a mass dash for the exit on NB-IoT.” This is the consensus, as per the ramble at the top of the piece. Ibraheem Kasujee, senior analyst at Analysys Mason, considers the AT&T decision in the context of its own operating environment. “[It] mostly relates to factors specific to the USA and to AT&T,” he says, pointing to the stateside dominance of LTE-M, and local differences with metering.

He continues: “Smart metering is by far the biggest use case for NB-IoT but most meter deployments in the US… use various [other proprietary 802.15.x] radio technologies in unlicensed spectrum. Taking smart meters out considerably reduces the addressable market for NB-IoT. Most of AT&T’s IoT customers are in automotive, retail, and healthcare – sectors for which NB-IoT is not typically a good fit. I expect NB-IoT accounts for a very small proportion of its total IoT connections – so the cost of losing some devices, or migrating them to LTE-M, was likely outweighed by the benefits of freeing-up spectrum capacity and other resources.”

A well-placed source at an IoT hardware vendor, who prefers to remain anonymous, suggests this whole IoT hygiene process is overdue, and that NB-IoT was always likely to get binned first. “It’s time for a cleanup of this fragmented IoT space, and NB-IoT is the natural target – especially with low adoption in the US,” he says, rattling through “price competitive” LTE-based IoT rivals (LTE-M and LTE Cat-1bis, notably), and foreshadowing novel ‘new-radio’ (NR) IoT alternatives (in the form at least two new 5G-era RedCap technologies). “It helps AT&T clear its IoT technology offering for when RedCap/eRedCap arrive, just around the corner,” he says.

“It has shown leadership in the US, I think – where NB-IoT is rarely used to its fullest value. It won’t lose its position in IoT, and it won’t lose customers.” As above, he also articulates this self-cannibalisation with NB-IoT/LTE-M around global coverage, and thus hardware costs and spectral efficiencies. “NB-IoT’s inherent value is its cost; that is the way it is often sold. The spectrum is practically free, like with SMS in the old days – because it uses the ‘guardband’ [of occupied LTE channels]. An NB-IoT-only module could be very cheap; there are examples going for less than $4. But because its global rollout has failed, the same as LTE-M, most modules are dual-mode LTE-M/NB-IoT.”

He adds: “And so the spectrum benefit of NB-IoT is not leveraged by carriers, and you pay for LTE-M technology, as well, for use in a lesser (lower-power and lower-margin) service. Why would anyone do that, especially in the US, which has very good LTE-M coverage? So NB-IoT does not bring extra value.” Which is the upshot; just because it is not allowed to show its true colours – which are about offering lowest-power, lowest-cost, lowest-complexity cellular for pulse-like IoT sensor comms. Will others follow suit? Verizon and T-Mobile in the US have been quoted elsewhere, to reaffirm their commitment to it. But it would hardly be a surprise if another one falls.

“We might expect others to take a similar decision,” remarks our source. “But it does not mean the death of NB-IoT. China is more focused on Cat-1bis now for IoT, but Europe is a stronghold for dual-mode NB-IoT/LTE-M – just to cover itself for its own fragmented regional strategy to adopt one or the other of them. It will be interesting to see the evolution of roaming agreements on low-power wide-area (LPWA) IoT connectivity, and whether this alone affords NB-IoT a lifeline.” Does Kasujee perceive a likely domino effect after AT&T’s logical and ruthless decision to cut its losses? Not really, he responds – for the same reasons as Hatton, earlier, and similar ones to our source, above.

Kasujee remarks: “I don’t think it’s the end of NB-IoT. Some operators that have deployed both, and seen more traction with LTE-M, may decide they don’t need NB-IoT. But we’ve also seen a slow but steady stream of smart meter contracts awarded to operators using NB-IoT – some of them for more than a million connections, and some on 10-plus year contracts. They won’t be shutting down NB-IoT anytime soon. Meanwhile, other use cases could yet emerge – like the emergency light beacons in Spain, which operators are targeting with NB-IoT to target – which could mean enough devices for operators to keep their NB-IoT networks running.”

Has NB-IoT failed, ultimately, as a global solution – does he think? Has cellular IoT, as defined originally by these twin LPWA network lightweights, failed? Kasujee responds: “While it is premature to say NB-IoT has failed, it is fair to say it has not met expectations – outside of China, which is an anomaly, but very clearly also a success story, with hundreds of millions of NB-IoT connections. Smart metering is the only use case where there’s been significant volume so far. NB-IoT has some limitations such as lack of support for SMS or eUICC and operators have struggled to work out the best approach to pricing as the low data rates mean the average revenue per connection is so low.”

He adds: “Maybe it ends up simply as a niche solution for smart metering – but it’s possible operators would have lost to LoRaWAN or other technologies without it. On cellular IoT, more broadly, it has only failed relative to expectations. Without those expectations, you see a market today with a few billion cellular IoT connections and double digit growth year-on-year. There may only be a handful of use cases such as connected cars and smart metering where it is really entrenched, but there are hundreds of other use cases where it is playing a small but important role. Plus, new cases are constantly popping up – like EV charging or smart labels.”

And meanwhile, RedCap looms on the horizon, and LTE switch-offs loom somewhere over it. But Hatton cautions: “RedCap is in no way ready to step in for NB-IoT or even LTE-M – at least for another [3GPP 5G NR] release or two. Today it’s only being used for gateways and a few modest use cases. Price, battery life, and functionality – not least that it needs 5G SA networks to be activated – are not even close to being able to hit the capabilities of those technologies. So there’s not an easy immediate migration path to a native 5G technology. There’s lots of work going on to develop RedCap, but the fundamentals mean it does not substitute for NB-IoT and won’t for five years at least.”

Kasujee agrees: “I don’t see RedCap as a replacement for NB-IoT, especially not in the short term. In terms of performance and battery life it’s closer to LTE-Cat-1, and LTE-M to some extent. Demand for RedCap will take a long time to build up as it will face the same issues NB-IoT and LTE-M faced when they launched – the time for chipsets, modules, and devices to be manufactured and commercialised, and the time for the prices to come down, which are currently way more expensive than existing technologies. So it’s a classic chicken-and-egg problem for RedCap, as it has been for NB-IoT – where demand is low because prices are high, and where prices only fall when volumes rise.”

So there. For more on RedCap, including how it will jostle for position with LTE-based NB-IoT and LTE-M (and LTE Cat 1-through-6) read the new editorial report from RCR Wireless, linked in the images above – or click here.

Leave a Reply