By James Blackman June 19, 2024

NB-IoT and LoRa-based IoT connectivity technologies have, and will continue to have, the lion’s share of the low-power wide-area (LPWA) end of the IoT networking market, reckons research house Omdia. The firm said the total number of IoT connections on the two technologies, operating in licensed and unlicensed spectrum bands, respectively, will reach more than 3.5 billion by 2030, and account for almost nine in 10 (86 percent of) IoT connections by the end of the period. Their joint share is about 87 percent now, it said.

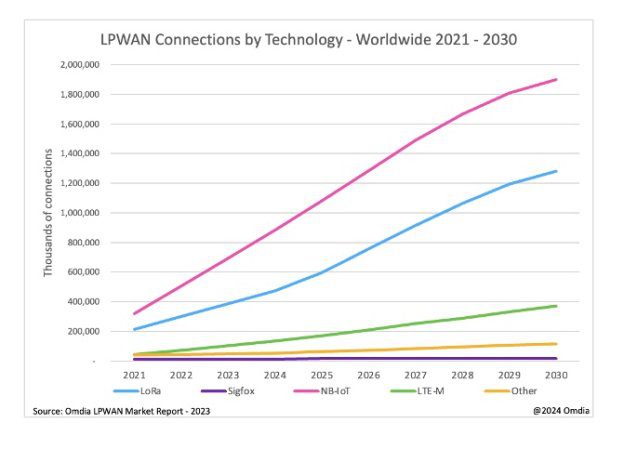

NB-IoT will remain the leading LPWA network (LPWAN) standard through the period – “driven by its popularity in China,” said Omdia, where 90 percent of its interests reside. It added: “LoRaWAN leads in most other regions.” As it stands, judging by a cursory look at a graph provided with an Omdia marketing note (see below), NB-IoT has around 900 million connections today, and will more than double its count to around 1.9 billion over the next five years. LoRa, including both proprietary LoRa and LoRaWAN connections, will jump in the period from around 500 million to 1.3 million.

Meanwhile, high-powered LTE-M, traditionally paired with NB-IoT as a cellular-based LPWAN twin-set, will go from somewhere north of 100 million connections in 2024 to something shy of 400 million in 2030 – representing the fastest growth of any of the ‘big’ LPWAN standards. By contrast, ‘other’ newer LPWAN technologies, notably Wi-SUN and MIOTY, will grow convincingly, also, in the period, from a joint total of about 20 million in 2024 to over 100 million in 2030. Growth of Sigfox, on the other hand, looks from the graph to be limited and flat-lining.

At the same time, the Sigfox crowd protested this week that Sigfox is “making a comeback” following a tough couple of years, which saw its bankruptcy and rescue under a more-open ownership, led by Singapore-based Unabiz. The installed base of Sigfox devices was 12.5 million at the end of 2023, the company said; but Sigfox South Africa has just been awarded a major smart water meter project that will contribute up to 15 million new water meters to the total, more than doubling its global total in a single swoop.

But the Omdia research put Sigfox firmly in the shade, and talked about the LPWAN market as a duopoly, effectively, split between NB-IoT’s dominance in China, particularly, and in public-network IoT, and LoRa/LoRaWAN’s mastery of the low-power private IoT networks space. “LoRa is expected to remain the preferred choice in private IoT connections, while NB-IoT will expand through cost-effective implementations, with both technologies poised for continued success through 2030,” said Shobhit Srivastava, senior principal analyst at Omdia.

In the end, LoRaWAN appears in the report as the biggest success. Srivastava said: “Although NB-IoT is the leading LPWAN technology, over 90 percent of its connections are in China. Outside China, LoRaWAN remains the leading LPWAN connectivity technology due to years of unchallenged growth and momentum. LoRaWAN, with its alliance-driven approach, boasts a mature ecosystem that allows customers to choose from a range of partners and application-specific experts. Its future success is assured by its differentiated offerings.

Srivastava added: “LoRaWAN is now focusing on high-growth areas, such as smart buildings, smart homes, and asset tracking.” He even credited the growth of Wi-SUN and MIOTY to the “successful alliance model that LoRa initially championed to develop an ecosystem”. Of NB-IoT, he said certain operator initiatives to deploy satellite-based NB-IoT to address coverage gaps, and certain government regulations as well, “will bolster NB-IoT growth” in Europe. But NB-IoT will remain a China story for the most part, he added.

“The Chinese government and the three national mobile operators continue to advocate for widespread NB-IoT adoption supported by Chinese chipset vendors. As Chinese vendors introduce affordable modules in Europe and South America, the technology will see further growth. NB-IoT use cases remain largely confined to stationary applications with the most popular being smart meters and water, gas, and electric utilities, and connected spaces / cities.”

Leave a Reply